The Best Ways to Consider Investing $1,000

Updated: November 7, 2019

It’s tax time. You’ve crunched the numbers, been thorough with your deductions and, to your surprise and delight, there’s an unexpected $1,000 coming to you via Uncle Sam. Or perhaps that lottery scratch-off revealed a $1K prize. Or your employer makes your holidays extra merry with a bonus grand. No matter where the $1000 comes from, what’s important is what you do with it. So, what’s the wisest thing to do with $1,000? Put it to work for you by investing it!

What is Investing and Why Investing Matters

Investing is simply committing cash to financial plans, property or other investment vehicles with the expectation of making more money--a profit. There are many ways to make better use of your money than parking it in a savings account.

How and where money is invested could make a difference in the amount of risk exposure and overall return received on the investment. Whether you are a new, less-experienced investor or one more seasoned, for those who are focused on building long-term wealth and financial security, risk management and a sensible allocation strategy are paramount. Though risk management is essential for all investors, each investor is different, meaning personal finances require a custom strategy that makes sense based on the individual’s financial needs in both the short and long term.

Now, let’s take that $1,000 and start putting it to work.

Ideas on Where to Invest Money

First let’s touch on what you should not do. Too many self-directed investors are quick to follow their gut or some hot stock tip from others and try to pick the next big winner. Many choose to invest their money by chasing after potentially lucrative, but equally risky investments such as the cryptocurrency assets. While these so-called strategies for investing money may seem attractive in the moment, they likely won’t garner the returns over time that are expected due to the high risk involved.

Instead, consider opting for one, or a combination of, more diversified, risk-controlled investments like the ones profiled here. While many folks aren’t quick to associate wealth with an initial $1,000 investment, the fact is that even wealthy investors had to start somewhere. Often, the hardest part is simply figuring out where that logical starting point is.

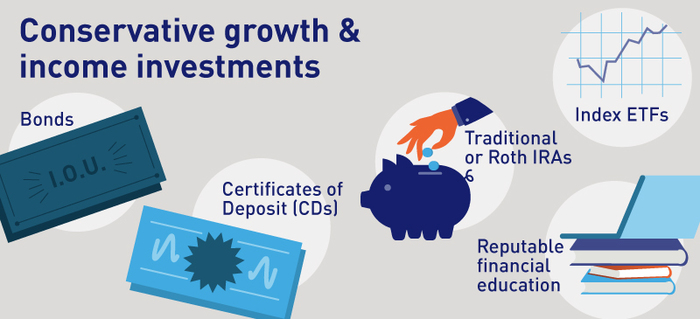

Conservative Growth & Income Investments

Most investors quit stashing money in their mattresses or burying it in the backyard a couple generations ago. And that’s because despite modern-day market volatility, the fact remains that capital prudently invested for the long term—say, 5-10 years or more—is still likely to increase in value.

For example, conservative assets or safe stores of value including gold, the US dollar and dollar-backed assets, blue chip stocks, utilities and consumer staples could all be reasonable choices for investing that first $1000. What follows are five additional investing ideas, all of which offer the three, specific qualities to look for from any safety-minded investment: 1) Relatively low risk profile, 2) Reasonable historic rate of return and 3) Low cost of ownership.

-

Bonds

In an era of historically low interest rates, bonds have been badly beleaguered, pushing investors to look elsewhere for a smart way to invest—like income stocks, ETFs, REITs, MLPs and even options strategies. But with interest rates moving and bond choices spanning more than just US Treasuries (corporate, foreign, etc.), gaining an understanding of the bond market and how these assets could help complement an investment portfolio is a prudent move for any investor.

-

Certificates of Deposit (CDs)

Admittedly, when CD rates are around 2.7%- 3%, there’s still a case to be made that CDs aren’t the best way to go. But again, if interest rates do continue going up—and economists universally agree that they will—it could enable risk-minded investors to generate competitive, essentially risk-free returns just by stashing cash in a CD for, say, 12-24 months.

-

Traditional or Roth IRAs

Tax advantages, dividend reinvestment and the potential for employer matching are all good reasons to opt for traditional and/or Roth IRAs. And with regular deferral and/or lump-sum contribution options available, these well-known retirement accounts could be prudent ways for investors to access low-cost funds and put cash to work in the markets.

-

Index ETFs

Index ETFs, like those that track the S&P 500, Nasdaq, etc., are great ways to heed the advice of Warren Buffett, who, along with in-depth data, showed that investors who simply stick to low-cost index funds tend to outperform the market. ETFs exist that track every index, sector, sub-group and even the farthest reaches of the financial markets. One ventures to guess that, if one were to ask Mr. Buffett himself how to invest that $1000, he’d likely say to buy an index fund or its corresponding ETF…and if it came from the ’Oracle of Omaha’, that sort of advice would have to count for something!

-

Reputable Financial Education

It’s easy to forget that knowledge and experience are powerful assets for self-directed investors. With that in mind, a smart way to invest money could be to choose to invest in a financial education. From simulated accounts, books and continuing education courses, to attending live events, trade shows and seminars, to group and even one-on-one mentoring, a price can’t be put on the value of an education. (Click to learn about Trading Academy’s free, introductory investing and trading class in your area.)

Shorter-Term, Variable-Risk Investments

There are also smart ways to invest for those looking for more aggressive growth and/or short-term income. Though more aggressive growth is synonymous with added risk, the educated investor should have a trading plan and risk management strategies in place to help manage their risk and control losses. The more an investor learns about the financial markets and the different asset classes, the more confident they should become in choosing ways to invest that could meet their needs both now and in the future.

-

Equities, Futures and/or Forex Trading

Millions of investors from all over the world try their hand at trading individual stocks, ETFs, futures, and/or foreign exchange (forex). Using online research and brokerage tools, it’s easy to set up and trade an own account with an initial deposit of $100 or less. While all of these could be a great way to invest money, the complexity of the markets and trading, not to mention the use of leverage, could pose serious threats and magnify the losses of inexperienced investors and traders. Bottom line, anyone interested in learning to trade the markets should invest in a proper education first!

-

Crowdfunding/Peer-to-Peer Lending

Crowdfunding today could represent a possible investment opportunity, with select crowdfunding investments offering potential returns that outperform the yields investors have (sadly) come to expect from traditional or fixed-income investments. Moreover, crowdfunding sites have been taking repeated steps to provide visibility and transparency, which helps investors to better identify and vet opportunities, access credit information and project track records, all of which could allow them to make more informed, and potentially smarter investing decisions.

-

Option Strategies

Versatility, low cost and ready access are just a few reasons why options have exploded in popularity in recent years. Option strategies range from puts and calls, to buying or selling more complex straddles, condors and the like. When it comes to option trading, strategies exist to help investors play the long or short side of individual stocks or assets to potentially meet short-term income goals and even speculate on news, economic data and/or corporate earnings reports. But as functional and popular as options are, just like stocks, futures and forex, the complexity and fast-moving nature of the option markets means that training and experience are a crucial step that could help you learn the skills designed to trade options confidently.

Unfortunately, there is no magic bullet investment that can easily grow initial capital with no downside risk. But there are plenty of choices out there that make it possible for investors to find one or more assets or asset classes to suit their individual goals and risk tolerance.

Ideas to Get Started Investing Money

There’s no question about it...making that very first investment is a big deal. But amidst all the excitement, nervousness and anticipation, it’s important to adopt a mindful attitude throughout the process and begin developing good habits as part of a calm, calculating approach to the markets.

How to Prepare to Make an Investment

-

Consider Goals

What is the purpose for investing money? Perhaps it’s facilitating long-term wealth, or generating short-term income. The answer to this question could do much to influence an investor’s strategy and eventual choice of investments.

-

Establish Rules and Risk Parameters

Much like business owners do with their business plan, new investors should have rules and guidelines which they use to direct and focus their efforts. For instance, what qualities (technical and/or fundamental) will be used to identify suitable equities or other investments to buy? There’s a myriad of choices here, everything from dividend yield to volume, P/E ratio to Fibonacci levels and much more. To decide which quality will work best for them, an investor should get educated and informed and do their homework before investing money in the markets.

-

Carefully Select Investment(s)

With rules and a clear purpose for investing established, it becomes time to select a stock, ETF or other investment to buy. When doing so, be decisive, trust your strategy and, particularly when investing for the long term, avoid constantly watching price action and living or dying by every up or down day.

-

Open and Fund an Investment Account

Lastly, investors would be wise to do their due diligence and select a reputable, well-qualified broker, advisor or portfolio manager. Today more than ever, the Internet makes it fast and easy to open accounts and electronically transfer funds from a bank, but first, investors should use that computing power to conduct their own, self-directed research about prospective brokers.

So beginner investors looking to get started in the markets should think conservatively at first; and for anyone interested in active trading or other riskier segments of the market, they should consider taking the time to get educated and informed before making that first foray into the markets.

Get Started with Your Financial Education

Get Started with Your Financial Education

This content is intended to provide educational information only. This information should not be construed

as individual or customized legal, tax, financial or investment services. As each individual's situation

is unique, a qualified professional should be consulted before making legal, tax, financial and investment

decisions.

The educational information provided in this article does not comprise any course or a part of any course

that may be used as an educational credit for any certification purpose and will not prepare any User

to be accredited for any licenses in any industry and will not prepare any User to get a job. Past

results are not a guaranty of future performance.