The Yield Curve as an Economic Forecasting Tool

Updated: October 3, 2019

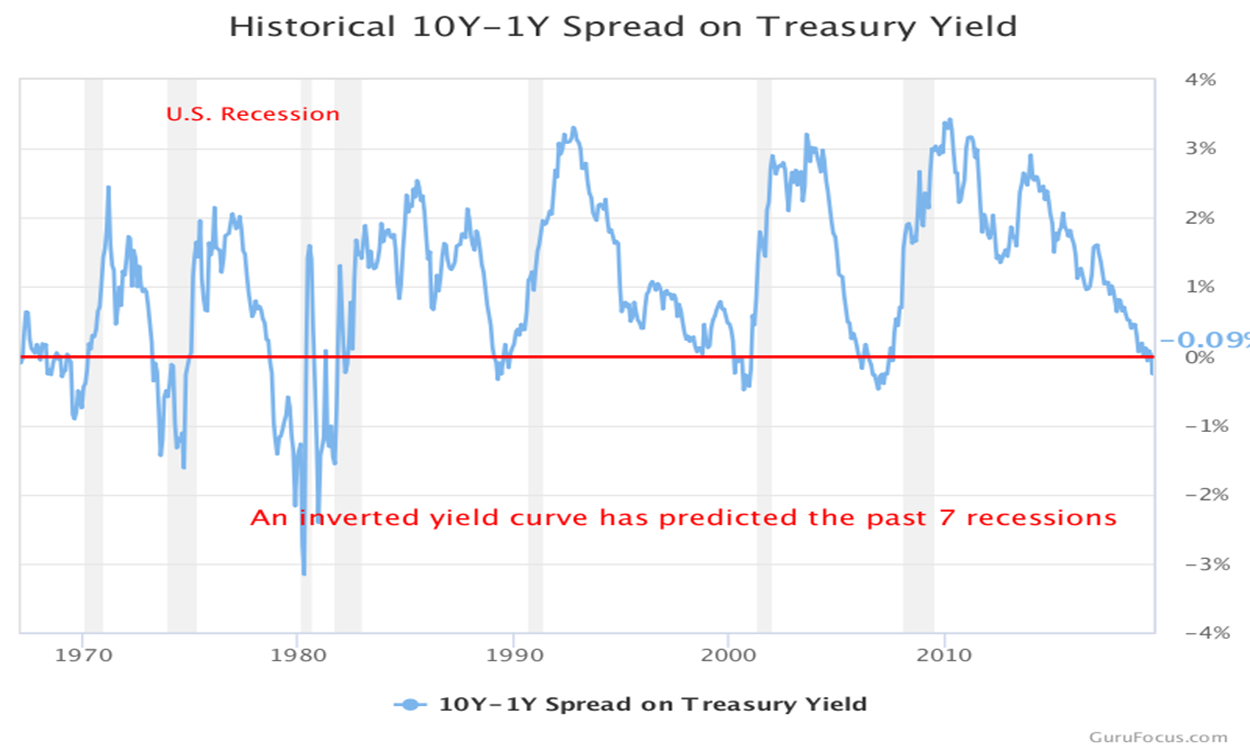

Shrewd investors and speculators are wise to look at the Treasury Yield curve as an indicator of where the U.S. economy is heading. Historically, it has been an incredibly accurate barometer to forecasting the economy. In fact, starting in the 1960’s the yield curve has accurately predicted the last 7 recessions the US economy has endured.

What is the Yield Curve

The yield curve is the rate that the US Treasuries offer investors to invest in various maturity instruments they offer, (Bills, Notes Bonds, ranging from maturities from 1 month to 30 years). It indicates the interest rates which the US government must pay to borrow money. When the short-term interest rates are higher than long term rates, that is called an “inversion”. This is not the traditional or normal environment.

Traditionally, we should expect long term rates to be higher than short term rates: meaning the longer tie you up your money, the more you should earn. When longer rates are higher than shorter term rates, that is called a “normal”, or “positive” yield curve. When the yield curve inverts, that is the marketplace predicting a recession. Each of the last 7 recessions were accurately predicted when the yield curve inverted within approximately a year of the economy entering that recession.

Illustrated in the chart below are the returns of the 1 year treasury, compared to the 10 year treasury. Each time the line drops below 0, that indicates that the 10 year yield was less than the one year (an inversion). Each of these 7 inversions going back to 1970, were a precursor to the recession that followed.

You can see how the shape and curve of the yield curve is constantly changing and acts as a predictor of the economy. Let’s take a look at some examples.

Positive or “Normal” Yield Curve

A normal yield curve is known for forecasting a strong economy. It coincides with positive economic growth, rising interest rates and increasing inflationary pressures.

Inverted Yield Curve

As described, an inverted curve is known for predicting an economic downturn (recession), resulting in diminishing economic growth, lowering interest rates and deflationary pressure. The past 7 recessions have all been accurately predated by an inversion of the yield curve.

“Flat” Yield Curve

A flat yield curve means that there has no substantial change in interest rates across the spectrum of maturities. It is typically a forecast for a lackluster or stagnant economy.

The yield curve is incredibly dynamic, moving as short term and long term interest rates change as a result of any variety of factors. It's easy to see why experts watch the yield curve considering its historical accuracy in predicting the future of the US economy. Investors, savers and speculators would be well advised to understand this relationship between interest rates, the economy and other asset categories like stocks, currency bonds and commodities.

About the Author

Bill Addiss

Bill Addiss develops and facilitates educational programs for a variety of major financial institutions, government agencies and foreign governments. He is the author of multiple financial guides as well as Boycott This Book, an upcoming study of how consumer boycotts have shaped U.S. history.

Get Started with Your Financial Education

This content is intended to provide educational information only. This information should not be construed

as individual or customized legal, tax, financial or investment services. As each individual's situation

is unique, a qualified professional should be consulted before making legal, tax, financial and investment

decisions.

The educational information provided in this article does not comprise any course or a part of any course

that may be used as an educational credit for any certification purpose and will not prepare any User

to be accredited for any licenses in any industry and will not prepare any User to get a job. Past

results are not a guaranty of future performance.