Investing in a Bear Market Using Sector Rotation

Updated: September 19, 2019

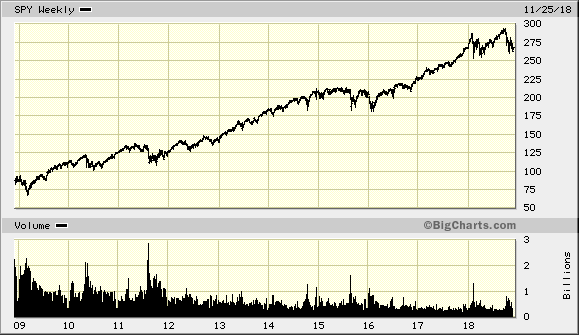

The chart below shows how the Standard and Poor’s Stock index has performed for the past decade. It has certainly had a record run. Increasingly, however, many investors and market professionals are worried that perhaps this bull market has run its course. The question now is, what to do next. If stock prices are in fact due for a correction or a more dramatic drop - a bear market, what is the investor to do? This article provides a few strategies that can be used by the retail as well as institutional investor using sector rotation during different economic cycles.

It is important to point out immediately that the economy and the stock market are two different entities. The economy reflects the production of all goods and services produced (as defined by Gross Domestic Product or GDP), whereas the stock market reflects the values of individual company’s stock that comprise that economy. For that reason, there is a strong correlation between the economy and the stock market. Within the stock market, similar stocks are grouped together and referred to as sectors.

How the S&P Index has performed

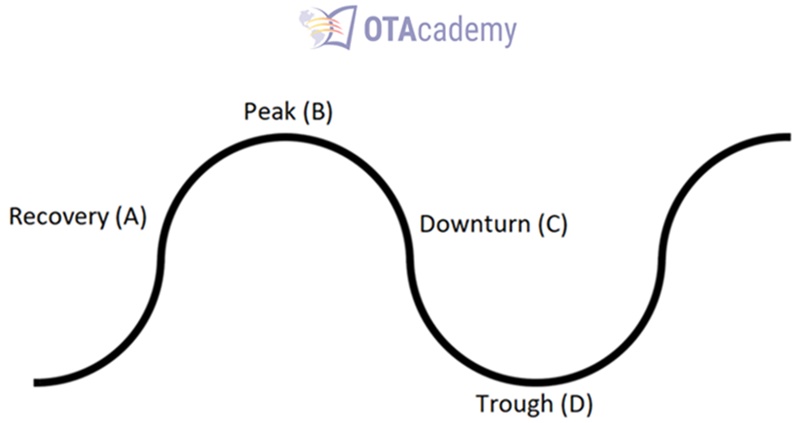

It is an established fact that different sectors (industries) which comprise the stock market perform differently during the various phases of the economic cycle. To further this conversation, it is necessary to discuss some basics of economic theory. As demonstrated in Illustration 2 below, economies move in cycles. Traditionally, economies experience a growth phase (A), eventually hitting a peak (B), which inevitably leads to a downturn (C), and at its lowest point of the downturn a trough (D). Note that at its worst, a trough can be a recession or depression, although it need not be that dramatic. Then the cycle repeats itself, returning to a growth phase. By almost every metric, our economy has been in a growth phase since the Great Recession (trough) of 2007-2008. And the stock market as shown above has reflected that growth.

Traditional Economic Cycle

What Are the Characteristics of Each Phase of the Economic Cycle?

As indicated above, there are 4 phases in an economic cycle. The below chart describes the characteristics of each phase.

| Economic Phase |

Characteristics of the Economic Cycle |

| Recovery (A) |

Consumer expectations rising, industrial production growing, interest rates rising, stock prices rising, GDP rising |

| Peak (B) |

GDP peaking, employment peaking, |

| Downturn (C) |

Consumer expectations falling, GDP falling, unemployment growing |

| Trough (D) |

Yield curve inverting or flattening, GDP low or negative, consumer expectations low |

Can You Protect and/or Grow Investments in a Market Downturn?

The good news is, yes, you could protect and even grow investments in an economic slowdown and corresponding market downturn. Below is an overview of some strategies discussed in a previous article you could consider using.

- Reduce your exposure to stocks: Looking at the allocation of your assets, you may want to reduce the amount of equities in your portfolio.

- Increase your cash holdings. This provides two benefits: 1) When prices do ultimately stabilize (the trough), you could have available cash to invest in the next recovery, and 2) if short term interest rates are rising, you could actually once again earn income on your cash and cash equivalents. For example, at the time of this writing,money market funds are yielding over 2.25%.

- Look at safer investments like bonds, which may offer short-term income, but not price growth (or price deterioration in the case of a down market)

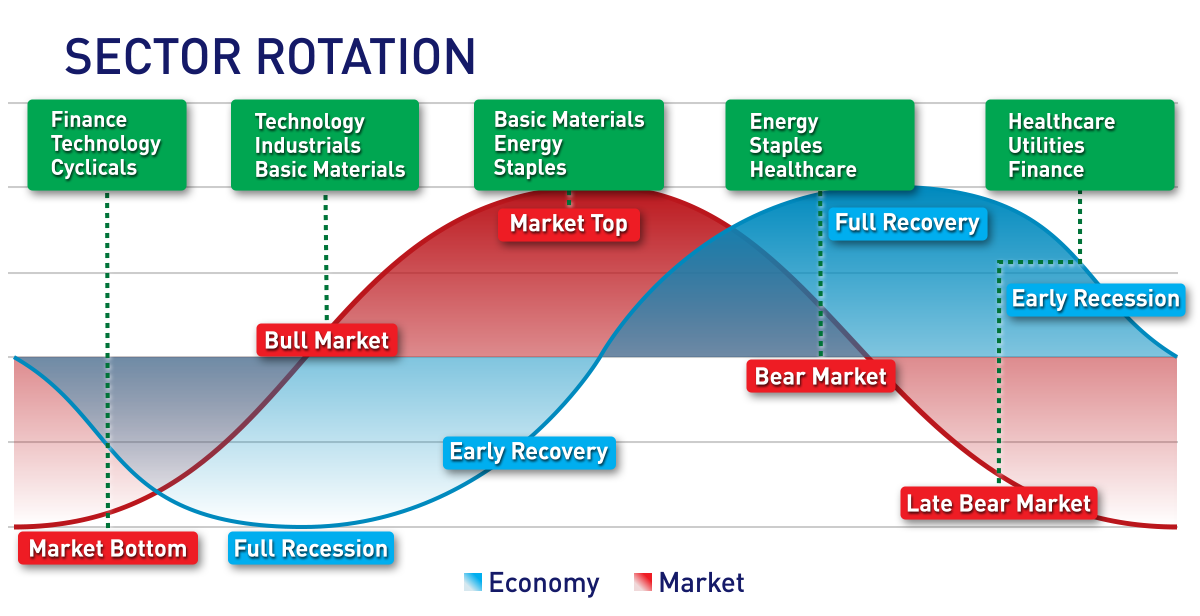

The Next Strategy: Equity Sector Rotation

Beyond the suggestions above, however, history has shown us that in an economic downturn there are certain industries or sectors which can actually perform quite well. By paying attention to which phase of the economic cycle we are in, and knowing which sector of the market performs best in that phase, active investors could take advantage of opportunities using sector rotation.

Defensive opportunities

Defensive sectors such as consumer staples, utility and health care stocks tend to outperform during a recessionary phase and should warrant particular attention in a bear market. These sectors are referred to as defensive because regardless of the economy and the amount of disposable income we have, certain expenditures are essential (health care, utility bills, consumer staples). Therefore, these companies provide a certain stability in an otherwise unstable market.

More aggressive opportunities

As you might imagine, there are certain industries which actually thrive in a weaker economy. These companies are called counter-cyclical. For example, in a weaker economy, discount retailers, discount food (fast food), and what are referred to as the sins (alcohol and tobacco), all tend to outperform. Interestingly, another industry which does well in a weak economy is the entertainment (movie) industry. Simply put, they are a cheap form of entertainment and escapism. It is no coincidence that the traditional major movie studios like MGM, Paramount and RKO were all founded in the great recession.

When looking to invest in a particular sector or industry which would offer these counter cyclical opportunities, it might also make sense to use ETFs (Exchange Traded Funds), as a way of getting exposure to these industries. Rather than individually picking companies within these sectors, there are a variety of sector funds offered by a variety of mutual fund families which offer exposure to these opportunities.

In conclusion, the point to be stressed is: Those stocks that perform well in a strong economy will likely not be the same stocks that will perform well in a weak economy! Are you prepared should the market and the economy be faltering?

It should also be stressed that sector rotation is most appropriate for long term investors. The economic cycles we have been discussing, can occur over a period of years. Our current period of growth has been occurring for over a decade now. Whether the assets are under the umbrella of an IRA, 401k or other long-term growth portfolio, this strategy is most appropriate when looking to take advantage of long-term investing opportunities.

Get Started with Your Financial Education

This content is intended to provide educational information only. This information should not be construed

as individual or customized legal, tax, financial or investment services. As each individual's situation

is unique, a qualified professional should be consulted before making legal, tax, financial and investment

decisions.

The educational information provided in this article does not comprise any course or a part of any course

that may be used as an educational credit for any certification purpose and will not prepare any User

to be accredited for any licenses in any industry and will not prepare any User to get a job. Past

results are not a guaranty of future performance.