Where are You on Your Learning Journey with Retail Trading? The Peak of Mount Stupid or the Valley of Despair?

You are not alone!

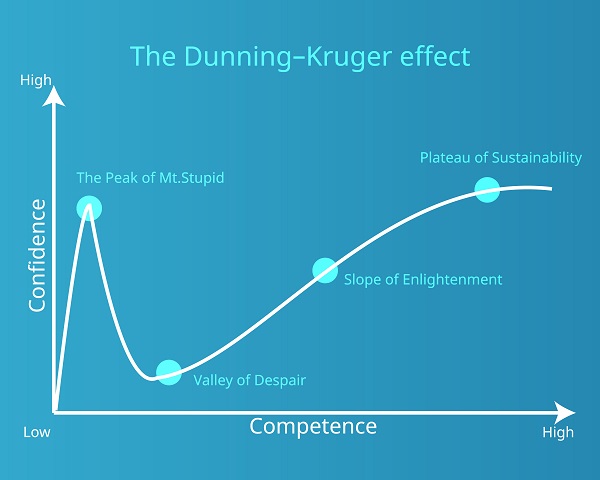

What are we talking about? One model we love as one way to summarize the learning journey as a retail trader is called the Dunning Kruger Effect model evolving from a research paper published in 1999 by psychologist Professors David Dunning and Justin Kruger. It summarizes the journey of learning anything complex as a progression of competence and confidence. Learning a sport or hobby or language or profession or trading and investing.

Many people rush to the peak of mount stupid! Their confidence outruns their competence.

- If they aren’t careful, they can be unconscious of their incompetence … they don’t know what they don’t know

- Perhaps they had some beginner’s luck … remember that saying, “everyone thinks they are a genius in a bull market”

- Perhaps they believe they can learn this from a book, or a YouTube video, or passively watching a guru or blindly following someone else’s picks? … would you take that approach to learning to fly a plane or your teenager learning to drive a car? That’s why we have “Driver’s Ed”, to accumulate practice behind the wheel with an experienced instructor in real driving conditions. It’s the same with Trader’s Ed, accumulating hands-on practice with an experienced instructor in real market conditions.

Soon thereafter, it is easy to crash down into the valley of despair! Their confidence takes a massive hit.

- They might become more conscious of their incompetence, beginning to know what they don’t know

- Their beginner’s luck can easily turn and become a run of bad luck, tinged with some gambler’s syndrome perhaps, with things easily going from bad to worse.

- They might even be overheard saying say things like “I can’t do this” expressing limiting beliefs or perhaps even, “it doesn’t work” excusing themselves of taking ownership.

If you think you are somewhere between “the peak of mount stupid” and the “valley of despair”, you are not alone! Reviewing the research out there about retail traders, it is hard to conclude anything else except that the majority of retail traders might be somewhere between “the peak of mount stupid” and the “valley of despair”. I wrote a compilation recently in the OTA Research Center trying to answer a question we often get asked, “What Percentage of Retail Traders Make Money?” That’s a difficult question to answer and you will need to decide for yourself. You can find the compilation at the OTA Research Center.

From the prevailing research that we can find, it is very hard to conclude that the percentage is anything but a small number, perhaps less than 24% and some say as low as 1%. It would seem therefore that a large majority of retail traders might be somewhere between “the peak of mount stupid” and the “valley of despair”. Only a small minority might have made it beyond on their learning journey to the “slope of enlightenment” and the “plateau of sustainability”.

Mind you, that’s not surprising when you when you notice a few commonplace perceptions that may be skewing the research and narrative:

- Firstly, “Day trading” is commonly used as a proxy for retail trading, which you will notice if you read the compilation articles, and even more so in the wider media. That might be the peak of mount stupid, as “Day trading” is just one style and time-frame of trading and investing on the spectrum. At Online Trading Academy, we teach both short-term trading strategies and long-term investing strategies, aligned with your financial goals.

- Secondly, “You can’t time the market” is also a very commonplace assertion… which you might also hear from your financial planner, especially just after a market correction or crash! That might be the valley of despair! Notice that these market timing studies often seem to be put out by fund management and financial planning organizations and often seem to be based upon the use of simple buy and hold and hope strategies, hoping to time-pick catching the best days and missing the worst days of the financial markets. Of course, as the saying goes, “hope is not a strategy”, so it isn’t at all surprising that this approach to market timing doesn’t work. If you are guessing, you are gambling! That view of market timing is like buying a lottery ticket. But, at Online Trading Academy, when we talk about “Market Timing” that isn’t what we mean. Instead, we mean something very different, educating students about a very different orientation to market timing which is new to most people. Our large database of rigorously tracked data reveals a different answer to the “can you time the markets?” question. Attend our Market Timing Orientation to find out more so that you can decide for yourself.

- Thirdly, being contrarian isn’t mentioned much in the compilation articles, as far as we can tell. In other words, not following the herd. The herd can easily rush to the peak of mount stupid and crash to the valley of despair! The market timing orientation we teach is very contrarian and you can find more in the OTA Research Center about the importance of being contrarian.

- Fourthly, differentiating between educated retail traders and uneducated ones doesn’t seem to be mentioned either. We believe that is essential. Having served over 80,000 students with lifelong trading and investing education for more than two decades, Online Trading Academy is well placed to research the sub-segment of educated retail traders and investors.

In our experience, getting educated with a contrarian methodology, based upon responsible risk management, are all essential to retail traders progressing to the “slope of enlightenment” and the “plateau of sustainability”

The “slope of enlightenment” is where things can start to progress.

- They might start to develop conscious competence, knowing what they know.

- We might overhear people saying “I realized I was the problem and that I needed to be the solution” taking ownership and “I am starting to get this” as they engage fully in the learning process of accumulating insights.

- They might put in the real work and practice of building skills, accumulating the repetitions of practicing, practicing, and practicing some more.

The “plateau of sustainability” is where things can start to click.

- Their skill, proficiency and confidence might have reached a level where they develop the unconscious competence of mastery, becoming so practiced and skilled that they don’t know what they don’t know. That’s often when students can become teachers, to give back by helping others on their journey, and one of the best ways to know what you know is to teach it to others.

Again, from our compilation of the research out there, it seems that only a small minority of retail traders and investors might have progressed to the “slope of enlightenment” and the “plateau of sustainability” … but those research articles and narratives do very little to differentiate between uneducated retail traders and educated ones.

Our research of our educated student community indicates substantially different data, telling a very different story of where the minority and majority are on the Dunning Kruger curve. Attend our Market Timing Orientation to find out more so that you can decide for yourself.