Diversification: How Much is Needed?

Diversification: How Much is Needed?

Do you know what Warren Buffett believes about Diversification? Many people think they do because of his famous quote, “Keep all your eggs in one basket, but watch that basket closely”. He also said, “Diversification is protection against ignorance. It makes little sense if you know what you are doing.” But his actual beliefs are more nuanced than that. He certainly hasn’t spent his career holding just one stock. It would be better said that he would approve of a reasonable number of investment opportunities that are well valued, IF you are willing and able to put in the work to know the difference between overvalued and undervalued.

But let’s get this right: The U.S. Major Markets are currently overvalued. All of them. By a lot. The S&P 500 is trading at 28 times earnings (almost double normal valuation). Exchange Traded Funds (ETF) are stocks with a single ticker symbol that represent a basket of stocks. For example, the S&P 500 ETF (Ticker: SPY) returned 26.18% in 2023 and 24.47% in 2024. 2025 Return = ???

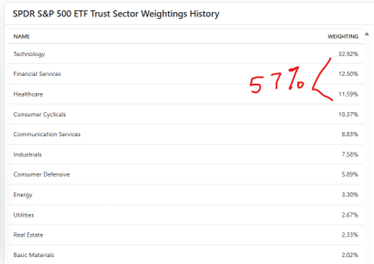

But wait, there’s more: If you thought you were diversified by holding an index ETF such as SPY, consider that one third of it is Technology, and over half of it is represented by just three sectors:

So how much is too much? One extreme is to remain 100% bullish on stocks and the other extreme is to be 100% bearish on stocks. Because markets tend to go up over time, it is not wrong to be long the markets most of the time. However, big losses can happen during bear markets. Likewise, it can be a maddening experience to be 100% net short while you wait for the bear market to happen.

Questions to ask yourself. While it is very much a personal decision as to how much to hedge, consider:

- When do you need the money? Are you investing for this week, the next 5 years, or the next 20+ years?

- How actively hands on do you intend to be with your trading?

- What is your level of experience and skill?

- Do you understand the many different ways there are to diversify your portfolio?

Specific Ways to Diversify Now. Never in the history of trading have we had so many different ways to diversify our personal portfolios. New ETF’s are launching on a regular basis representing very diverse market niches. Any of these ETF stocks can be purchased by an individual investor in their own personal trading accounts and elsewhere. It is also possible to trade Options on many of them.

Each of the Sectors listed above has more than one sector ETF associated with it. For example, you could trade the ETF ‘XLU’ if you wanted to focus on utilities or ‘XLK’ if you wanted to add more technology to your portfolio. There are also subsector niches such as ‘SMH’ that is an ETF that represents a basket of only semiconductor stocks.

What if you are bearish, but you don’t understand options or are not comfortable shorting shares of stock? There are bearish ETF’s. For example, if you were bearish on the overall market, you could trade the stock ‘SH’, which does the exact opposite of the S&P 500. If the market goes up, SH goes down. If the market goes down, SH goes up. There are many bearish ETF’s for different factions of the market. 587 to be precise. One thing to be cautious of is how long you hold these leveraged or inverse ETFs. The longer you hold them, the more value they will lose.

In addition, there are ways to broaden your portfolio outside of traditional U.S. stocks. Crypto Currencies have sparked a lot of interest in recent years (as well as creating some very wealthy people). Many individuals would love to participate in investing in Bitcoin, for example, but haven’t a clue how to purchase a Crypto investment. Enter the new family of Crypto ETF’s such as ‘IBIT’ which tracks the performance of Bitcoin. Now the average person has a way to have a Crypto investment without opening a Coinbase account or being concerned about being hacked or losing control of their assets. Again, its important to understand how these ETF’s are built. They are all different and you should know what’s under the hood. In our Digital Asset Focus course, we cover all facets of digital assets and cryptocurrencies, including which are the best ETF’s to trade.

How about something conservative, like Bonds? Yep. There are ETF’s for that, too, such as TLT, SHY, JNK and many more.

Finally, let’s not forget that there is another world of corporate equity investing outside of the United States. You can find ETF’s for emerging markets, Asian markets, European markets, and more.

The Best Choice. Once you decide how you want to diversify your holdings in any kind of market, consider having a team of experienced people help you with your educational journey. TradingAcademy has built a wealth of resources to help you in your journey. Whether it be live classes, online courses or tools and calculators to plan your next move, we’ve got you covered.