2025 Mid-Year Summary and Outlook

2025 Mid-Year Summary and Outlook

Traders, 2025’s been a heart-pounding market marathon, and we’re only halfway through! For active traders, this year’s volatility, tariff shocks, potential WW3 and crypto adoption—supercharged by the GENIUS Act—have created a playground of opportunities. Let’s dive into the major trends, macro headlines, compare 2025 to historical norms, and chart the course for the rest of the year. Strap in, craft a rock-solid plan, and tap into Trading Academy’s resources to keep your head in the game!

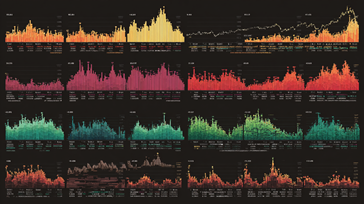

2025 So Far: A Volatile Beast

The S&P 500 kicked off 2025 at nosebleed valuations, with a forward P/E of 21, riding the tailwinds of 23% and 24% gains in 2023 and 2024. But February’s tariff threats sparked a 17% plunge by April, driven by a tech-led selloff. A 27% rebound by June showed the market’s grit, though choppiness persists. The VIX spiked in April, to levels last seen during the pandemic (with the 8/5/2024 surge), signaling a trader’s market where quick moves pay off.

Tariff Turmoil: President Trump’s return unleashed trade policy chaos—145% tariffs on China, 50% on the EU—rattling global equities. A 90-day tariff pause and US-China trade talks, dropping Chinese tariffs to 55%, fueled a rally. Emerging markets, especially China’s stimulus-driven equities, outperformed the S&P, echoing 2017’s global growth spurt. With average tariff rates at 15%—the highest since the 1930s—uncertainty keeps traders and the Federal Reserve on their toes.

Middle East Conflict: Financial markets are on high alert as tensions between Iran and Israel escalate, with U.S. involvement amplifying the risk of broader conflict. Now a Ceasefire is in place, but how long will that last? Earlier this year, markets were focused on tariff turmoil driven by President Trump—but that’s now taken a backseat to the rising threat of full-scale war. Talk of World War III isn’t just headline bait—it’s fueling volatility across energy, defense, and global equities. As uncertainty deepens, expect investors to rotate into defensive sectors and seek refuge in safe-haven assets like gold, the U.S. dollar, and Treasuries. The risk landscape has changed—and fast.

Tech and Value Pivot: AI stocks like Nvidia and Salesforce tanked in January after China’s DeepSeek AI model spooked investors. While most big tech is back to near the highs, there are some notable laggards. Apple has struggled heavily, holding losses of over 20% for the year, and Tesla, facing backlash from Elon Musk’s political involvement, is still down over 15% for the year.

Inflation and Rates: CPI cooled to 2.4% in May from 2.9% in 2024, with Core PCE projected at 2.3%. The Fed’s holding rates at 4.25–4.5%, and claiming to be “Data Dependent”. However, market speculators are predicting 2, 25-basis-point cuts by the end of the year. The 10-year Treasury yield (4.25–4.75%) pressures equities but opens fixed-income plays. Oil is the big wildcard with the escalating tensions between Iran and Israel, creating significant increases in volatility for Oil. Tread with caution in this market!

Consumer and Labor: Consumer confidence hit near-record lows, but the labor market’s solid. One of the Feds’ primary rate decision tools is Unemployment, and that number has remained constant at 4.2%, a good supporting component for a potential upcoming rate cut by the FOMC.

Crypto’s Rise and the GENIUS Act

Cryptocurrency’s been 2025’s breakout star, turbocharged by the GENIUS Act’s passage on June 17th. This game-changing law established Stablecoin rules and regulations for the domestic market. This added a significant acknowledgement of digital asset validity. The GENIUS Act was the first step, and opens the doorway to the Clarity Act, which is now working its way through the legislative channels. Bitcoin broke to all-time highs before retreating and consolidating, as did much of the crypto space. As the Clarity Act gets closer to the finish line, the real winners and losers will start to become much clearer. The Stablecoin infrastructure will also help bolster blockchains like Solana, Cardano, Near and many others. One thing for sure, digital assets are here to stay!

Historical Context

After two 20%+ S&P years, history suggests a third year brings 10% gains on average, per CFRA. 2025’s range-bound S&P (4,835–6,147) mirrors 2015 and 2018, years of 4–6% returns, not the dot-com frenzy of 1999 when P/E ratios hit 50–75x. Today’s mega-caps trade at saner multiples, and earnings growth is spreading beyond the Magnificent Seven. Volatility’s high but shy of 2008’s panic, with solid fundamentals capping downside. Crypto’s surge recalls 2017’s Bitcoin rally, but the GENIUS Act adds stability in absent prior booms.

Opportunities for Active Traders

Here’s your playbook:

- Value hunters and long term investors will be looking to underperforming sectors such as Healthcare, Consumer Discretionary and Energy, the biggest losers so far this year.

- Crypto Trades: Bitcoin has cemented its dominance in the digital asset world; however many Altcoins are poised for big moves! This will be directly influenced by the series of legislative bills currently making their way through the House of Representatives and Senate. This market is juicy for risk-takers, tread lightly and be sure to stay on top of the daily changes. Crypto is the fastest moving market of them all!

- Commodities: As always, market uncertainty can wreak havoc on the dollar. The Dollar index is headed down quickly and broke key levels just a week ago. With this current trend, keep an eye on commodities!

- Hedges: Gold still shines as a broad market hedge and short-term Treasuries balance tariff risks.

Outlook for 2025

The remainder of 2025 is teetering on a few things: Tariffs, Trade, Taxes, Inflation and Interest rates. From a probability perspective, it’s very likely that the next few months bring clarity to the global trade tensions. With that uncertainty behind us, the markets will most likely continue to trend higher. That said, all it takes is one shock to the system to derail the current uptrend that’s been rolling since April. Small-caps and value stocks could shine if the Fed cuts rates (two expected). Crypto’s rally should roll on as adoption is at an all-time high. The GENIUS Act and the repeal of SAB21, open the doorway for traditional banking institutions to enter the digital asset arena. This will further push adoption and demand for digital assets. Geopolitical risks, like Middle East tensions, could spike & crash oil over and over again. While this may present some great trading opportunities, it may also send you to your local CVS to stock up on Ulcer meds! The key for the next 6 months will be to diversify across equities, crypto, and hedges like gold or REITs.

Traders—2025 is packed with potential, and it’s yours to capture!

In fast-moving markets, preparation isn’t optional—it’s your edge. Volatility doesn’t have to be scary—it’s fuel for smart, confident traders who come in with a plan. That means setting your risk, using stop-losses, and following your strategy with discipline.

The good news? You’re not in this alone.

Trading Academy is your power-up: expert-led classes, online self-paced content and a vibrant community of traders ready to help you stay sharp and focused. Tap into the momentum with General XLT sessions, connect at community events, or dive into our educational resources from anywhere in the world.

This year’s just getting started. Stay locked in, lean on your resources, and let’s make 2025 your strongest trading year yet.

Plan smart. Trade strong. Let’s go!