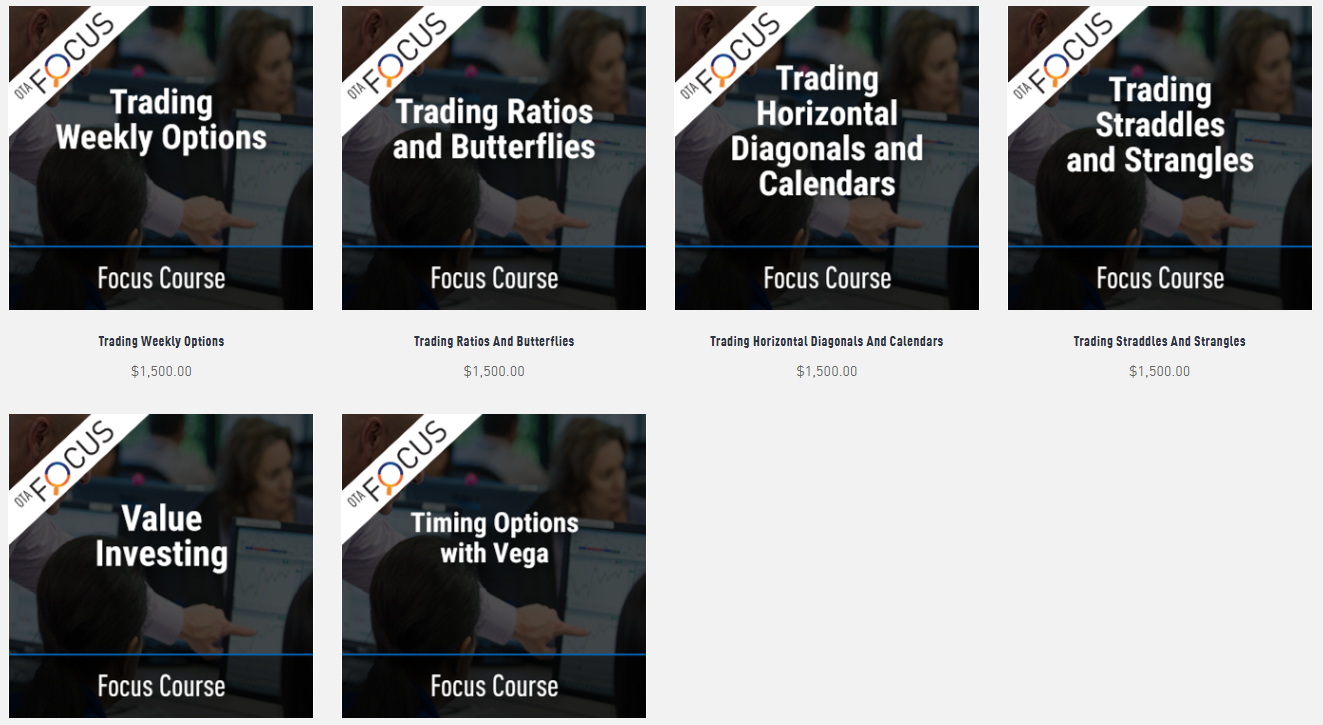

Add to your toolkit our latest Focus Courses!

Just in time for the fall, we have recently introduced two new focus courses to help you manage risk through today’s volatility and uncertainty.

Introducing:

Value Investing - When someone begins their journey in financial education and trading the financial markets, they are often attracted to leveraged asset classes such as Futures, Forex, and Options due to their capacity to generate short-term income. However, trading short-term should only be done using one's "risk money", so what can an investor do with the rest of their net worth, their "wealth bucket"? This is where long-term investing using Fundamental Analysis comes in. This class will teach investors how to screen through the thousands of public companies for strong candidates, how to further analyze these candidates Quantitatively and Qualitatively, and how to calculate their Intrinsic Value using the Discounted Cash Flow model.

Timing Options with Vega - The number of Option choices and strategies are potentially endless, but they do not need to be so complicated for individual traders. This course is designed to time classic option strategies using Vega, which measures an option’s sensitivity to changes in the volatility of the underlying asset. This is done while looking for yield, length of hold, risk profile, and insurance. Students will work towards creating more efficient and consistent entries, quality yields, and shorter duration.

For students interested in more about Options, these impactful courses will focus on understanding how to protect finances with very specific Options Strategies.

Horizontal and Diagonal Calendars highlight strategies that allow investors to replace shares of stock with a longer-term option, thus potentially combining the power of leverage AND income at the same time!

Straddles and Strangles offer an earnings play designed to benefit from increasing volatility in a certain part of the earnings cycle.

When market conditions are a bit too low for credit strategies and a bit too high for debit strategies, Ratios and Butterflies with proper risk management can be a viable alternative.

...and our first Focus course Trading Weekly Options explores the risks and potential value of Options when high volatility is in play.

To see the full line-up of Focus courses, click here. We invite you to become part of the community of ‘Focused’ Traders.