Learn Your Way Around Traditional and Roth IRAs

Long-term-focused investors commonly opt for individual retirement accounts, or IRAs, in an effort to grow and protect savings throughout the course of their working careers. The various tax advantages, relatively low cost, and ease of access are all viable reasons why. However, it’s important for self-directed investors, and even those who participate in employer-sponsored retirement programs, to know the "lay of the land’", as it were, and how to incorporate traditional and/or Roth IRAs as a component of—not a singular solution to—their overall retirement saving strategy.

What’s the Difference Between Traditional and Roth IRAs?

First, it's worth noting that the IRA universe is more broad than just traditional and Roth IRAs. Simple and SEP IRAs are also available, with many sole proprietors, freelancers, and self-employed individuals today opting for the latter. And separate from those are 401(k) accounts, which are yet another retirement-specific investing option. For practical purposes, however, we’ll examine Traditional versus Roth IRAs since they are the most common and why different investors might opt for one over the other.

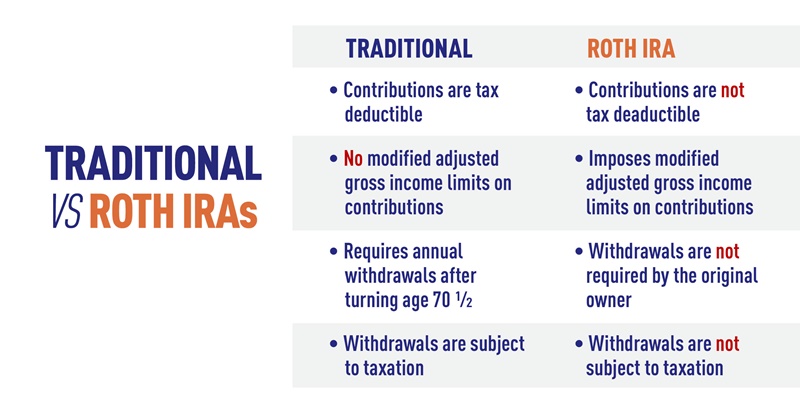

To put it most simply, the deciding factors when choosing between traditional and Roth IRAs are likely to be income and tax implications. Both types of IRAs are similar, and for 2024, have the same contribution limit of $7,000 annually ($8,000 if age 50 or older). However, certain income restrictions exist that might preclude more affluent investors from opening a Roth IRA. This table shows whether your contribution to a Roth IRA is affected by the amount of your modified AGI (Adjusted Gross Income) as computed for Roth IRA purpose.

On the tax front, Roth IRA contributions use after-tax income, which makes eventual distributions tax and penalty free, unlike traditional IRA distributions which are subject to income and capital gains taxes since contributions were pre-tax to begin with.

Another difference between traditional and Roth IRAs is that traditional IRA distributions must begin at or around age 70, while Roth IRAs aren’t restricted in that sense. That means those who plan to (or must) work into their 70s will likely opt for a Roth over a traditional IRA.

It’s always a good idea to consult reputable tax and financial professionals for personalized guidance, but generally speaking, Roth IRAs make better investing choices for those who qualify based on their household income threshold. Traditional IRAs, on the other hand, are open to investors in higher tax brackets. Conventional wisdom tends to go against utilizing both types of these IRAs simultaneously, if possible, to ensure consistent tax and distribution protocol, and alleviate the need to monitor and manage multiple accounts.

Keys to Successful Investing Using IRAs

Choosing which IRA best fits your needs and retirement saving strategy is important, but it’s only a first step. That’s because opening an account, selecting initial investments, and conducting regular maintenance and rebalancing is crucial to your IRA’s ultimate performance.

As with any other type of investment, it’s important to know and understand pertinent rules and regulations up front, and with IRAs (like with 401(k) accounts), investors must be mindful of costs associated with investing and ongoing account maintenance.

Some of the most critical functions for IRA investors will include:

Choosing a Broker

It will likely come as no surprise that in today’s digital era, investors have more choices than ever before when searching for a reputable brokerage offering IRAs. Mainstream brokerages—Fidelity, E-Trade, Vanguard, T. Rowe Price et. al.—are worthy of consideration, but so, too, are the relatively new class of robo-advisors, whose innovative technologies help reduce investment costs and may even offer some unique value to IRA investors. Even banks may offer IRAs, although generally speaking, the primary choices for investors are most likely to be brokerages and robo-advisors.

For active and/or self-directed investors who want to choose their own investments and be hands on, the big brokerages will probably be the best bet. There, the wide range of relatively-low-cost investments and wide range of choices (stocks, mutual funds, ETFs, etc.) may make it worth paying slightly higher fees to have the desired flexibility.

On the other hand, more passive investors or those who want to be hands off when it comes to picking and managing investments, might be wise to opt for a robo-advisor instead of a more traditional brokerage.

Regardless of individual preferences and investment history, the qualities to look for with any prospective IRA provider are:

- Low-cost investment choices

- Low, transparent Fee structure

- Investment advice or assistance, if needed

- Readily available customer service/support

Selecting and Allocating Initial Investments

The long-term focus of traditional and Roth IRAs means that younger investors have more time to weather the inevitable downturns and recover even sizable losses. However, that’s not a green light to significantly overweight growth stocks or risk assets in an IRA.

Essentially, the goal with an IRA is to build a portfolio of diversified and sensible low-cost assets that is likely to produce healthy returns in the long run. With that, investors in their 20s and 30s might follow the popular 60/40 rule, allocating 60% of a self-directed IRA to equities (stocks, bonds, ETFs, etc.) and 40% to bonds and fixed-income investments. Then, as retirement draws closer, it’s often wise to scale out of risk assets like equities, and overweight bonds and fixed-income instead. Tax implications also tend to favor diversifying between equities and bonds/fixed-income investments in IRAs.

Investors would always be wise, however, to carefully diversify equity holdings across many different stocks, sectors and industry groups in an effort to shield against inevitable risk. And honestly, one perfectly acceptable way to do that is to not pick individual stocks for an IRA in the first place, favoring instead a diversified selection of low-cost funds.

That may include:

- Exchange Traded Funds (ETFs): ETFs enable investors to buy entire baskets of high-performing stocks from a given market, sector or industry group, and the low cost basis makes ETFs favorable assets for IRAs. As such, an investor might opt to carry index ETFs in an IRA to track the broad market, and can also diversify across sector ETFs that isolate different growth- and income-focused corners of the market (technology, utilities, commodities, consumer staples, etc.).

- Market Index Funds: For investors who want to be largely hands off with regard to their IRA, simply buying index mutual funds that cover the broad market isn’t the worst way to go. Here again, low cost and exposure to the whole of the market could be advantageous over the long term. Many studies have shown, in fact, that most self-directed investors achieve better performance with plain old index funds than they do when rotating their way in and out of various sectors, stocks and asset classes.

- Diversified No-Load Mutual Funds: The mutual fund universe is colossal, with funds offering broad and even highly targeted exposure to different indexes and even the most obscure corners of the market. No-load funds feature very low cost basis, which is especially appealing to IRA investors who might be wise to pick a handful of well-diversified mutual funds from leading brokerage houses and let them work for a course of several years.

- Target Date Funds: Something of a more recent innovation, target date funds adjust for risk exposure based on the time frame. With that, investors nearing retirement would select shorter-term target date funds, whose holdings would be more conservative and likely to include blue chip stocks, bonds and fixed-income assets. On the other hand, younger investors who are willing and able to bear more risk would select long-range target date funds, which would tend to have a more aggressive growth component. Long and short-range target date funds both make excellent additions to IRAs as well.

Ongoing Account Maintenance & Rebalancing

The phrase set it and forget it tends to come up a lot when talking about longer-term investing and swing trading, and although IRAs are long-term focused by their very nature, the importance of regular portfolio monitoring, maintenance and rebalancing really can’t be overstated. Though there’s a bit of a caveat here: In the name of cost control, investors can’t afford to adjust IRA holdings every month, or whenever fear and turbulence strikes the market. That’s because changing IRA positions or allocations costs money with every transaction, and those costs add up quickly and can eat away at any gains—especially short-term ones.

Realistically, it’s prudent to analyze IRA holdings and performance quarterly at most, but certainly once annually to ensure holdings are still appropriate given any new economic or market forces that cropped up since the last assessment. In the event that an account is suddenly overexposed to non-favorable sectors or asset classes, this can be rectified in that once-yearly IRA check up.

Whenever performing annual maintenance and rebalancing, investors should act logically, ensuring sensible allocations to both equities and bonds/fixed-income, and broad diversification across multiple indexes, sectors, and asset classes showing relative strength for the time being and the year or so ahead. In bullish conditions, that may include technology, consumer discretionary, and index funds in general. And conversely, in more bearish conditions, investors might opt for more (relative) safety in the form of funds that follow utilities, consumer staples, bonds, and even commodities like gold and silver.

Overall, traditional and Roth IRAs are widely considered valuable components of most any long-term financial plans. The tax advantages and compounding interest alone makes Roth IRAs in particular attractive tools for younger investors who are starting to establish and build savings for their (distant) retirement.

Much like with any portfolio of long-term investments, traditional and Roth IRAs require a lot of patience and cost-consciousness, and perhaps less market expertise than many might initially assume. Considering the rise of robo-advisors and the prevalence of low-cost ETFs, index and mutual funds, even inexperienced investors could rather securely put money to work in preparation for the ultimate financial goal, a prosperous retirement.